Factoring

Factoring is becoming more and more important! The factoring market itself is currently unregulated and difficult to understand. We will advise you in detail on the subject of factoring and will always find a reputable factoring provider (factoring bank) for you, regardless of whether in Germany, Austria or Switzerland, who will be a long-term and reliable financing partner for you.

What is factoring

Factoring definition: Factoring is the ongoing sale of a company’s accounts receivable from deliveries and services to the factoring company (factor). In return, you receive immediate liquidity, usually 80% to 90% of the respective invoice amount is transferred immediately to your bank account.

You will receive the remaining 10% to 20% as soon as your customer has paid their invoice in full, but no later than 150 days after the invoice is due, regardless of whether your customer pays or not. The factoring company therefore usually assumes the entire risk of default (del credere).

You therefore have revolving, direct liquidity and can grant your customers a payment term of up to approx. 120 days.

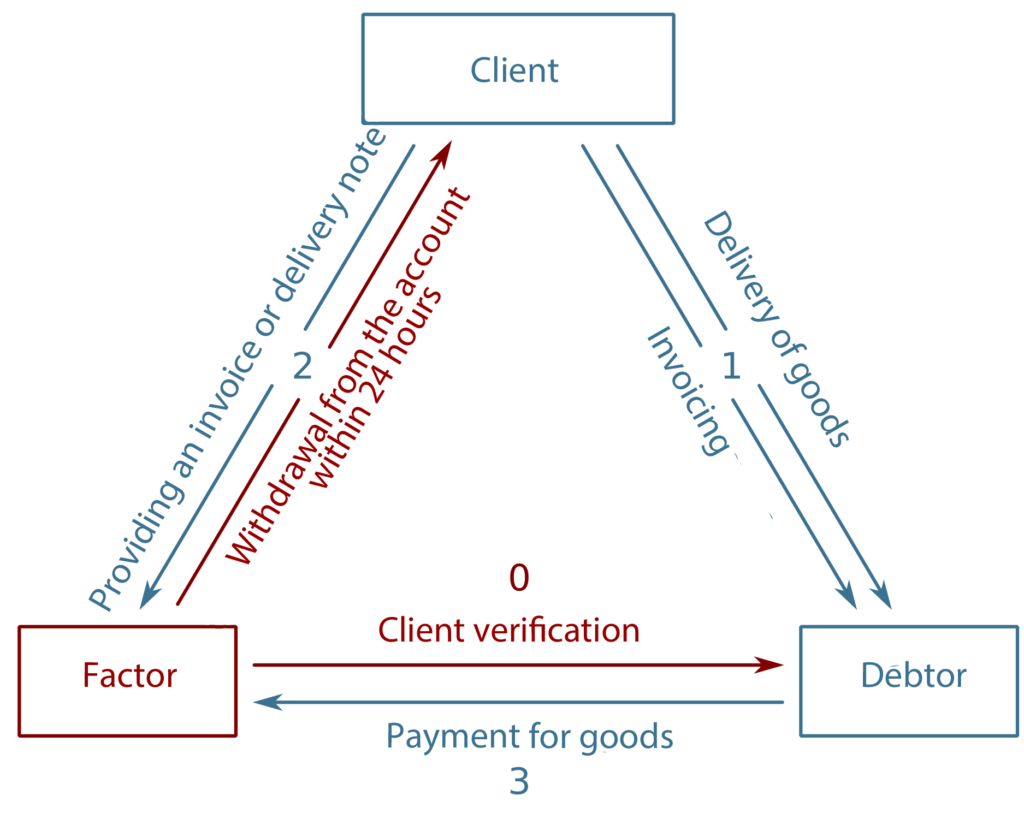

Process

Advantages

Liquidity:

Increase in liquidity through the sale of outstanding debts and their immediate payment by the factor. You are quickly liquid, even if your customer has not yet paid. This directly supports your sales growth and expands your financial flexibility.

Risk protection:

The factoring company usually assumes 100% of the default risk of its receivables. You can also hedge your default risk with trade credit insurance, but this does not give you immediate liquidity and always has a deductible.

Reduced workload:

The factoring company taking over accounts receivable accounting and dunning enables savings in personnel and material costs.

Rating improvement:

The sold receivables leave your balance sheet and the improved liquidity situation allows you to reduce your liabilities, for example, which leads to a lower balance sheet total. This increases the equity ratio and improves your bank rating.

Competitive advantage:

The liquidity gain allows you to grant your customers longer payment terms. Your reaction speed to market developments increases and you, as an entrepreneur, have financial leeway for investments that permanently secure your competitive advantages.

Factoring and bank

The bank is often unable to accompany sales growth with a necessary increase in the current account limit. The commercial bank is not prepared to accept the company’s receivables as collateral in sufficient amounts. As a result, many entrepreneurs find themselves in economically unfavorable liquidity problems. There is a lack of financing that matches sales.

Factoring offers an alternative here, as in addition to revolving liquidity, the del credere, the default protection, is a high level of security!

Factoring costs

The usual cost model for factoring consists of two parts: factoring fee and factoring interest. The factoring fee is based on the amount of annual sales, with the company’s creditworthiness and the composition of the receivables playing a decisive role. The interest rates are based on current current account interest rates and tend to be around 2% to 3% lower. The advantage over a regular loan is that this interest is calculated on a daily basis and only for the loan actually used.

Further information on the subject of „factoring“

Real and fake factoring

Real factoring

In so-called real factoring, the factor assumes the del credere risk, i.e. the risk of non-payment.

This offers a significant increase in security for the factoring customer: even if the debtor is insolvent or unwilling to pay, the invoice amount is paid out by the factor to the factoring customer.

Real factoring can be divided into individual forms, depending on which additional services are provided by the factor.

Fake factoring

In contrast to real factoring, the factor does not assume the del credere function in fake factoring, which means that the risk of non-payment remains with the factoring customer. If the debtor does not settle the outstanding debts, the factor must repay the advance previously received to the factor.

The liquidity gained through factoring is therefore not secured in the case of non-genuine factoring. Accounts receivable accounting cannot be completely handed over to the factor either, as the factoring customer must monitor the payment of invoices by the debtor.